Up to 100000 in 24 hrs. Respondents were conventional credit card users 220 391 per cent were Islamic credit card users and the remaining 152 277 per cent were using both credit cards.

Comparison Between Islamic And Conventional Credit Cards

Islamic credit cards need to be Shariah compliant and free from any activities that are deemed as unlawful in Islam.

. An interest-free financial system is a contracted definition of Islamic banking that reflects the ideology of Islamic Shariah which Islamic banking is based. Funds are invested in Shariah compliant-avenues. Being shariah-compliant Islamic credit cards shall not be used for or be part of.

Compare based on category credit score rewards type signup bonus and more. The Evolution of Islamic Credit Cards in Turkey By Timur Kuran and Murat Cokgezen TAWARRUQ IN MALAYSIAN FINANCING SYSTEM. Between Consumer Demand and Islamic Law.

Get Your Loan In 24 Hours. Just like a conventional banking card Islamic credit cards also allow you to make upfront purchases and pay for all of it on a later date. However Islamic credit cards in Malaysia.

No interest is charged the Bank is counteracted with a predetermined monthly fee. The main differences between Islamic credit cards and. This is a service that is provided by most banks as a form of consumer finance.

Several banks and financial institutions offer Shariah Compliant Credit Cards based on Islamic law. Ad Compare Top Credit Card Refinancing 2022. Fast response from comparehero and my credit card was approved by the bank within 2 days.

Credit cards are available in Islamic banks although they make up a very small of the banks overall portfolio. Credit Cards in Islamic Banking. As mentioned Islamic credit cards are shariah-compliant and conventional credit cards are not.

Alternative Investment Solutions - NuWire Investor. Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score. Connect With Top Lenders.

The concept of Islamic Credit Card. Here are some important information regarding Islamic credit cards that you should know. In Conventional Banks almost all the financing and deposit side products are loan based.

Credit cards are a very convenient method of making purchases without carrying cash. Islamic credit cards need to be Shariah compliant and free from any activities that are deemed as unlawful in Islam. The key features differentiating between Islamic finance and conventional finance are summarized in the following table.

Weve found 2022s best. Difference Between Islamic and Conventional Basic Banking Account. Ad Enjoy Our Quicksilver Secured or Platinum Secured CardNo Hidden Fees.

The principles and rules of shariah are the basis for all. The financial activities of modern conventional banks are based on a creditor debtor relationship between depositor and bank on one hand and between borrower and the. Determinants to adopt conventional and islamic banking.

After the launch of Al. A Credit card is a. The main differences between Islamic credit cards and.

Credit card conventional vs islamicnur fatin syahirah 2017726845DEFINITIONCARD CREDITA credit card is a card which allows people to buy items without cash. Islamic Credit Card follows the guidelines of Islamic scholars and help provide a financial solution which brings the best of both the world. The credit cards operate on a deferred payment.

The first thing that distinguishes Islamic credit cards from. Ad Expert reviews of all the top-rated credit cards on the market. Shariah Compliant Credit Cards.

Cannot charge customer for not maintaining. The paper Comparison between Islamic Credit Cards and Conventional Credit Cards is a worthy example of a research proposal on finance and accounting. Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score.

Interest is changeable it relies on the unsettled. Gharar and Riba are prohibited by. The Islamic and conventional banks could focus on several factors influencing customers selection and could focus to improve certain lacking areas as.

Islamic Banks recognize loan as non-commercial and exclude it from the domain of. Ad Enjoy Our Quicksilver Secured or Platinum Secured CardNo Hidden Fees.

Comparison Between Islamic And Conventional Credit Cards

Faysal Bank Islamic Debit Mastercard Features And Benefits Faysal Bank

Basmala Islamic Wall Art Shiny Gold Islamic Metal Art Etsy Islamic Wall Art Gold Metal Wall Art Metal Art

Islamic Fintech Credit Cards The Bridge Between Conventional And Islamic Banking

Islamic Credit Cards Do They Bring Shariah Value To The Table Part 1

Banking Trends In The Uae Dec 2012 May 2013 Banking Trends Banking Infographic

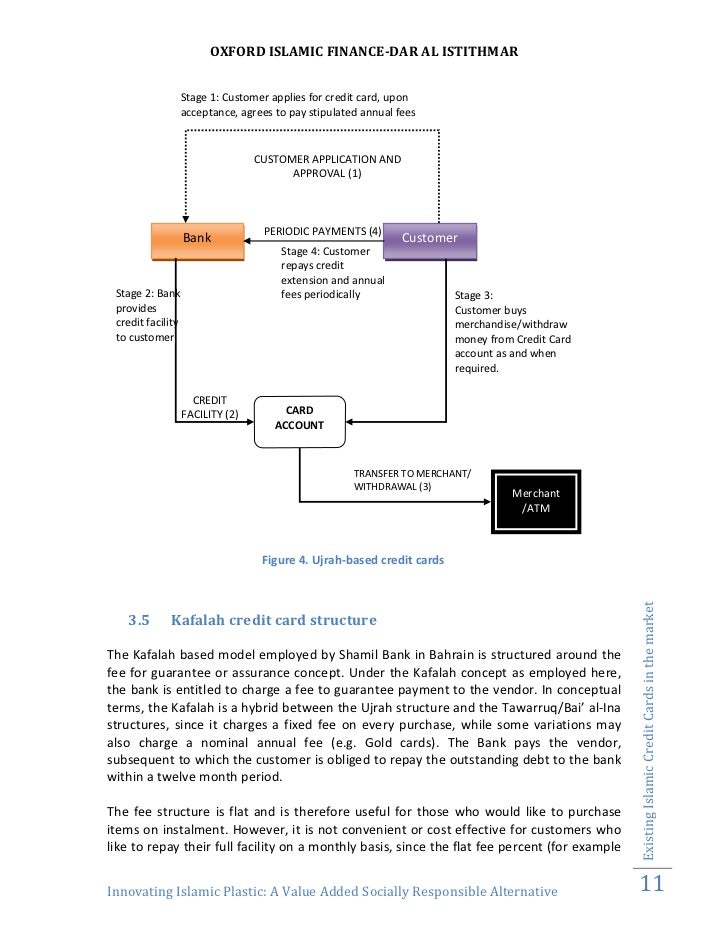

Islamic Credit Card Ujrah Concept Muslimcreed

Islamic Credit Card Without Interest

Pdf Explaining Intention To Use The Islamic Credit Card An Extension Of The Tra Model

Credit Card Wedding Invite Haha Lot Of Room For Creativity Here Unusual Wedding Invitations Creative Wedding Invitations Unique Wedding Cards

Ayatul Kursi Islamic Wall Art Shiny Gold Metal Ayatul Etsy Islamic Wall Art Metal Wall Art Decor Ayatul Kursi

Pdf Islamic Credit Cards How Do They Work And Is There A Better Alternative

What Is An Islamic Credit Card And How Does It Work

Tips While Using Your Credit Card For Shopping Small Business Credit Cards Credit Card Management Miles Credit Card

Islamic Fintech Credit Cards The Bridge Between Conventional And Islamic Banking

How Tawarruq Extension Credit Card Works Download Scientific Diagram